38 consider a bond paying a coupon rate of 10 per year semiannually when the market

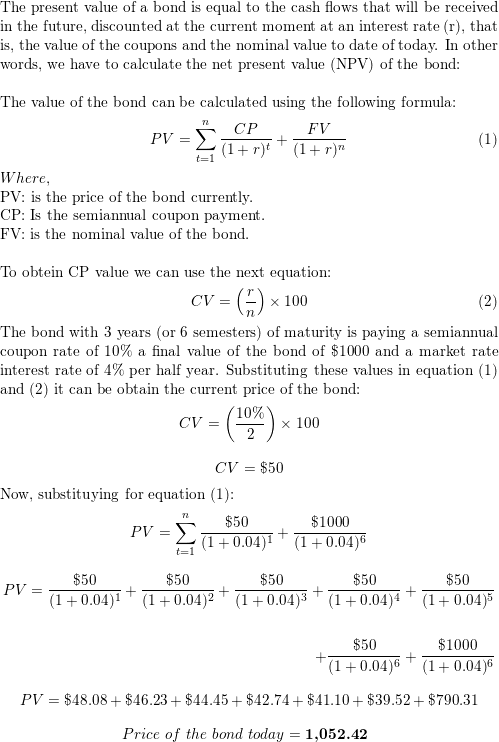

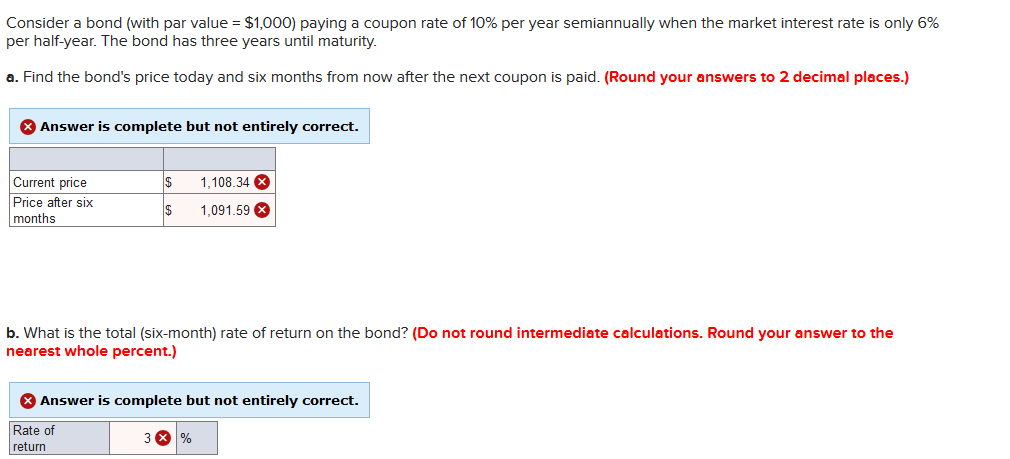

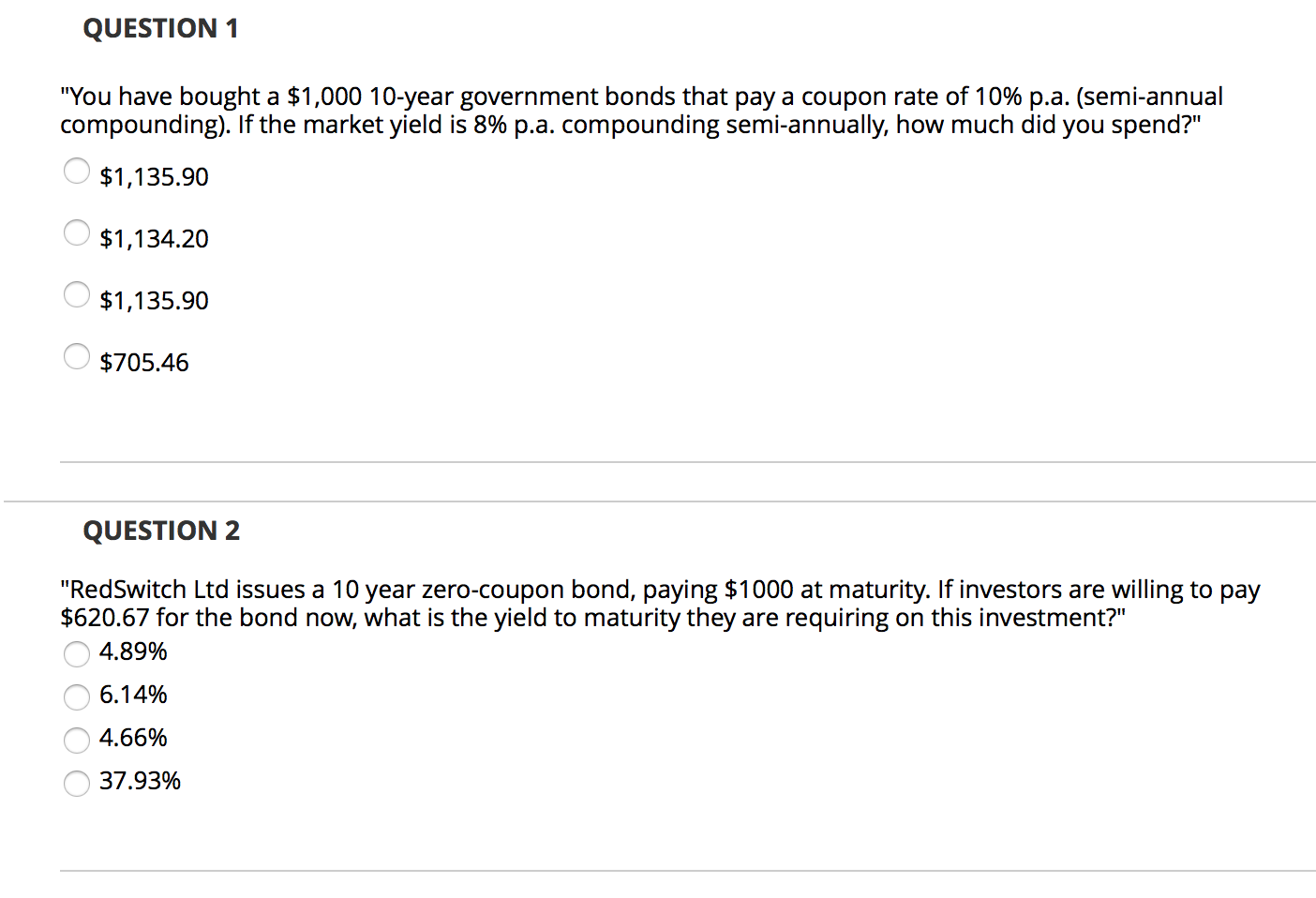

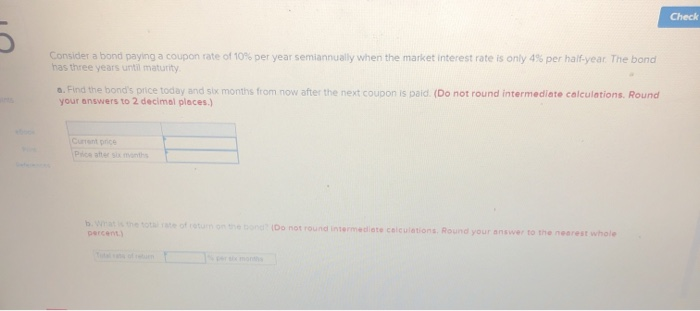

Solved = Consider a bond (with par value = $1,000) paying a - Chegg Question: = Consider a bond (with par value = $1,000) paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.) Practice problems - Consider a bond paying a coupon rate of 10% per ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Solved Consider a bond paying a coupon rate of 10% per - Chegg See the answer Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. Find the bond's six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expert Answer

Consider a bond paying a coupon rate of 10 per year semiannually when the market

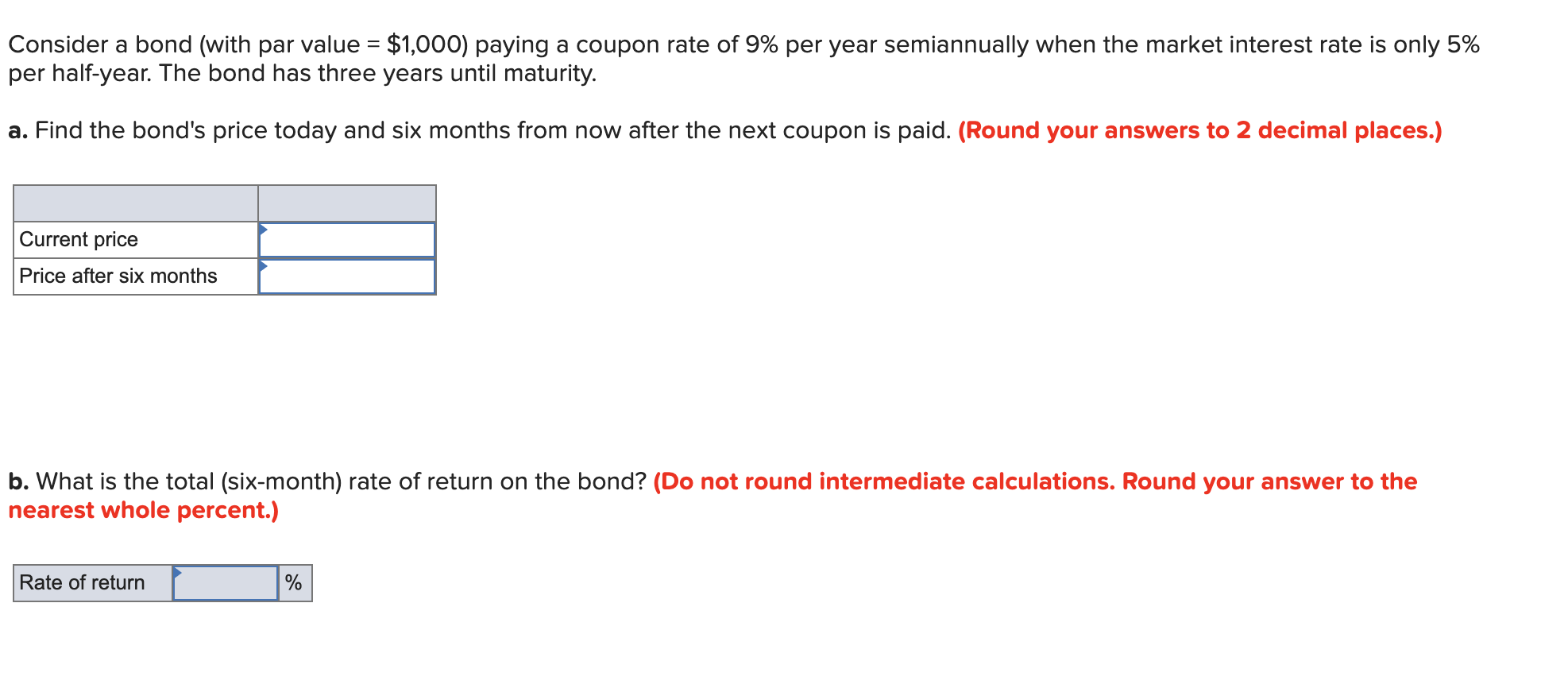

Solved Consider a bond (with par value = $1,000) paying a | Chegg.com See the answer Consider a bond (with par value = $1,000) paying a coupon rate of 8% per year semiannually when the market interest rate is only 3% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. (Round your answers to 2 decimal places. Consider a bond paying a coupon rate of 10% per year semiann - Quizlet From the statement of the exercise, we know that the bond, which matures after three years, pays a coupon rate of 10 % 10 \% 10% per year every six months when the market interest rate is 4 % 4 \% 4% for half a year. Therefore, annually the bond pays 0.1 ($ 1000) = $ 100 0.1(\$1000)=\$100 0.1 ($1000) = $100, which represents a semi-annual payment of $ 50 \$50 $50. Hence, we have: Solved Consider a bond paying a coupon rate of 10% per year - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond? Question: Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity.

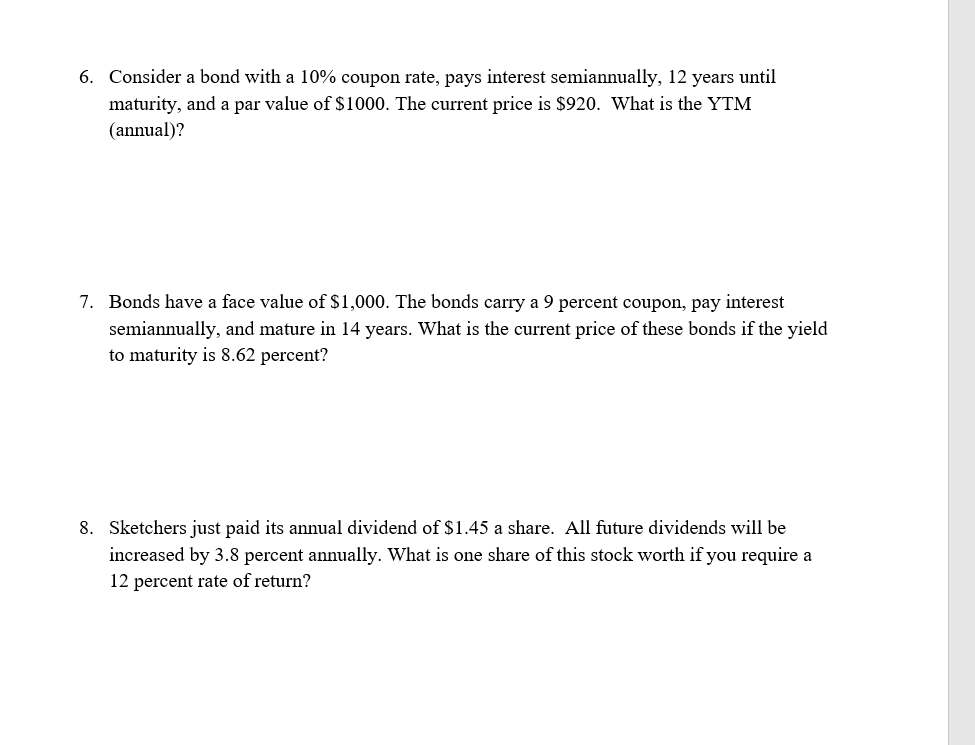

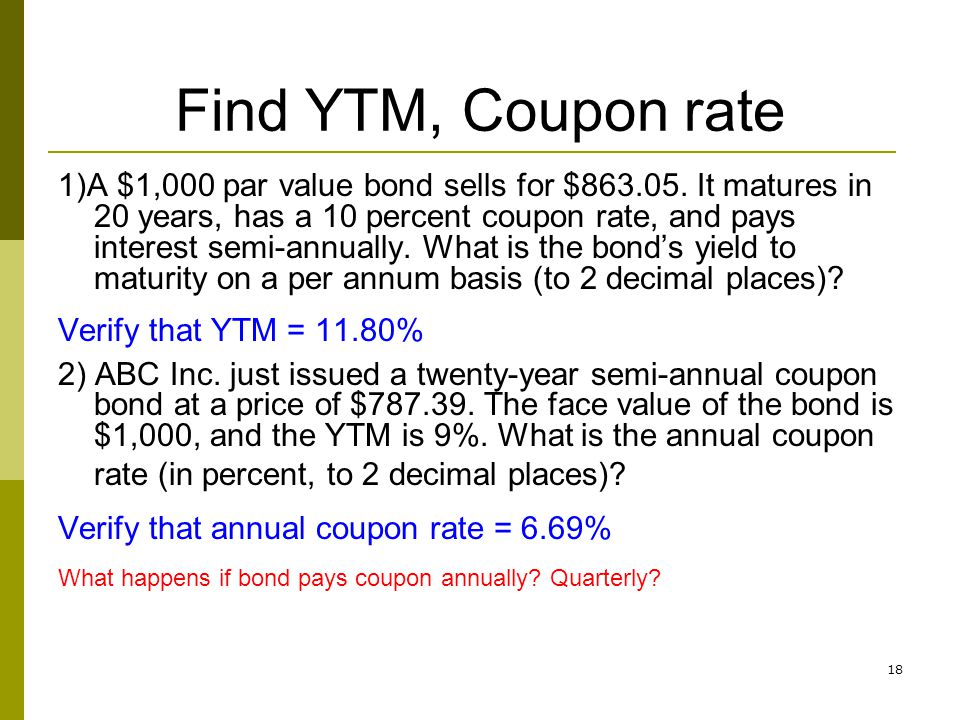

Consider a bond paying a coupon rate of 10 per year semiannually when the market. Foundations of Finance - Class 8 and 9 - Quizlet All have the same degree of default risk and mature in 10 years. The first is a zero-coupon bond that pays $1,000 at maturity. The second has an 8% coupon rate and pays the $80 coupon once per year. The third has a 10% coupon rate and pays the $100 coupon once per year. a. If all three bonds are now priced to yield 8% to maturity, what are their prices? When is a bond's coupon rate and yield to maturity the same? - Investopedia For example, if a company issues a $1,000 bond with a 4% interest rate, but the government subsequently raises the minimum interest rate to 5%, then any new bonds being issued have higher coupon ... Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, 1. Consider a bond paying a coupon rate of 10% per year...open 5 - Quesba 1. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond? 2.

Solved Consider a bond paying a coupon rate of 10.50% per - Chegg Question: Consider a bond paying a coupon rate of 10.50% per year semiannually when the market interest rate is only 4.2% per half-year. The bond has two years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) (Get Answer) - Consider a bond paying a coupon rate of 9.25% per year ... Consider a bond paying a coupon rate of 9.25% per year semiannually when the market interest rate... Consider a bond paying a coupon rate of 9.25% per year semiannually when the market interest rate is only 3.7% per half-year. The bond has five years until maturity a. Find the bond's price today and six months from now alter the next coupon is ... Investments Final Flashcards | Quizlet Terms in this set (52) Consider a bond paying a coupon rate of 10% per year semi-annually when the market rate of interest is 8.5% per year. The bond has three years until maturity. Calculate the bond's price today. A zero coupon bond has a par value of $1,000, a market price of $150 and 20 years to maturity. Fin 311 - ch. 10 homework - bond prices and yields - Quizlet 16 Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. find the bond's price today and six months from now after the next coupon is paid. b. what is the total rate of return on the bond? ...

Finance Investments Chapter 10 HW - FINC 3440 - SU - StuDocu Consider a bond paying a coupon rate of 7% per year semiannually when the market interest rate is only 3% per half-year. The bond has six years until maturity. ... 8% coupon bond paying coupons semiannually is callable in six years at a call price of $1,105. The bond currently sells at a yield to maturity of 7% (3% per half-year). 1. Consider a bond paying a coupon rate of 10% per year...get 5 - Quesba Face Value = $1,000 Annual Coupon Rate = 10% Semi-annual Coupon Rate = 5% Semi-annual Coupon = 5%*$1,000 = $50 Semi-annual YTM = 4%. Today: Time to Maturity = 3 years. Price = $50 x PVIFA(4%, 6) + $1,000 x PVIF(4%, 6) Six months from now: Time to Maturity = 2.5 years. Price = $50 x PVIFA(4%, 5) + $1,000 x PVIF(4%, 5) b. Rate of Return = [(P1 + C - P0)/P0] here Consider a bond paying a coupon rate of $10\%$ per year semi | Quizlet Question Consider a bond paying a coupon rate of 10\% 10% per year semiannually when the market interest rate is only 4\% 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond? Solution Verified Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The issuer makes periodic interest payments until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template

Consider a bond (with par value = $1,000) paying a coupon rate of 8% ... Consider a bond (with par value = $1,000) paying a coupon rate of 8% per year semiannually when the market interest rate is only 6% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.)

Answered: Consider a bond paying a coupon rate of… | bartleby Question Q4: Consider a bond paying a coupon rate of 10% per year semi-annually when the market interest rate is only 4% per half-year. The bond has three years until maturity. This initial payment is $1000. A: What is find the bond's price today and 6 months time after the next coupon is paid? Expert Solution Want to see the full answer?

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased.

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

Consider a bond paying a coupon rate of 10% per year semiannually when ... Semiannual coupon payment; PMT = (10%/2 )*1000 = 50. Semiannual interest rate; I/Y = 4%/2 = 2%. then CPT PV = 6-months from today, you will use the following inputs to find new price; Maturity of bond(6-months later); N = 2.5 *2 = 5. Face value ; FV = 1000. Semiannual coupon payment; PMT = (10%/2 )*1000 = 50. Semiannual interest rate; I/Y = 4%/2 = 2%. then CPT PV =

Bond Coupon Interest Rate: How It Affects Price - Investopedia Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's par value, also known as the "face value." A $1,000 bond has a face value of $1,000. If its coupon rate...

Consider a bond paying a coupon rate of 10 per year semiannually when ... The 3 year bond is paying a 10% coupon rate (semi-annually) that has a market rate interest rate of 4% per half year. a. Calculate the bond price. PMT = (10%/2 x 1,000) = 50 FV = 1,000 n = 3 years x 2 = 6 r = 4% PV = 1,052.42 Price of the bond six months from now can be calculated by assuming that market interest rate remains 4% per half year.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate. 1. The ...

Answered: Consider a bond paying a coupon rate of… | bartleby Consider a bond paying a coupon rate of 10% per year semi-annually when the market interest rate is only 4% per half-year. The bond has three years until maturity. This initial payment is $1000. A: What is find the bond's price today and 6 months time after the next coupon is paid? B: What is the total rate of return on the bond? Expert Solution

Answered: Consider a bond paying a coupon rate of… | bartleby Question. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b.

Solved Consider a bond paying a coupon rate of 10% per year - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond? Question: Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity.

Consider a bond paying a coupon rate of 10% per year semiann - Quizlet From the statement of the exercise, we know that the bond, which matures after three years, pays a coupon rate of 10 % 10 \% 10% per year every six months when the market interest rate is 4 % 4 \% 4% for half a year. Therefore, annually the bond pays 0.1 ($ 1000) = $ 100 0.1(\$1000)=\$100 0.1 ($1000) = $100, which represents a semi-annual payment of $ 50 \$50 $50. Hence, we have:

Solved Consider a bond (with par value = $1,000) paying a | Chegg.com See the answer Consider a bond (with par value = $1,000) paying a coupon rate of 8% per year semiannually when the market interest rate is only 3% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. (Round your answers to 2 decimal places.

/bond.asp_final-76c865e23abe4f6c9e7c41a38cfe6e39.png)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "38 consider a bond paying a coupon rate of 10 per year semiannually when the market"