39 zero coupon bond investopedia

Zero-Coupon Certificate of Deposit (CD) Definition - Investopedia The term "zero-coupon" comes from the fact that these investments have no annual interest payments, which are also referred to as " coupons ". Zero-coupon CDs are considered a low-risk investment.... What does it mean if a bond has a zero coupon rate? - Investopedia A zero coupon bond generally has a reduced market price relative to its par value because the purchaser must maintain ownership of the bond until maturity to turn a profit. A bond that sells for...

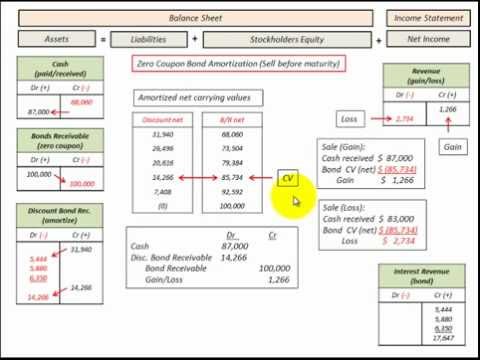

Zero Coupon Bond Definition Formula Examples Calculations A zero coupon bond can be described as a financial instrument that does not render interest. they normally trade at high discounts, and offer full face par value, at the time of maturity. the spread between the purchase price of the bond and the price that the bondholder receives at maturity is described as the profit of the bondholder.

Zero coupon bond investopedia

India Government Bonds - Yields Curve India Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. 38 zero coupon bonds advantages groww.in › p › government-bondsGovernment Bonds India - Types, Advantages and Disadvantages ... Zero-Coupon Bonds. As the name suggest... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

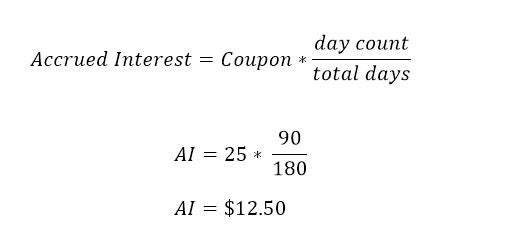

Zero coupon bond investopedia. government bond - Yahoo Search Results › what-are-government. Aug 26, 2021 · Government bonds are issued by governments to pay for services or other obligations. The issuer promises to pay the lender a specified rate of interest during the life of the bond through annual or semiannual payments. This is called "the coupon" or " coupon rate .". All the 21 Types of Bonds | General Features and Valuation | eFM A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. What Is a Zero Coupon Yield Curve? - Smart Capital Mind A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity. This face value is the equivalent of the principal invested plus interest over the life of the bond. Bonds Vs. CDs - Forbes Advisor For zero coupon bonds, interest is paid at bond maturity. ... Since most bonds pay a regular "coupon" or interest payment, bonds are valuable for investors who want a fixed income at set ...

Coupon Rate Formula & Calculation - Study.com Examples of How to Calculate Coupon Rate. Company ABZ is raising capital for its new project by issuing bonds in the capital market. The company is issuing 20,000 bonds at $1,000 par value that ... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-coupon bonds essentially lock the investor into a guaranteed reinvestment rate. This arrangement can be most advantageous when interest rates are high and when placed in tax-advantaged... › the-basics-of-bondsThe Basics Of Bonds - Investopedia Jul 31, 2022 · Investopedia does not include all offers available in the marketplace. Service. Name. ... What is the difference between a zero-coupon bond and a regular bond? 21 of 28. How Bond Market Pricing Works.

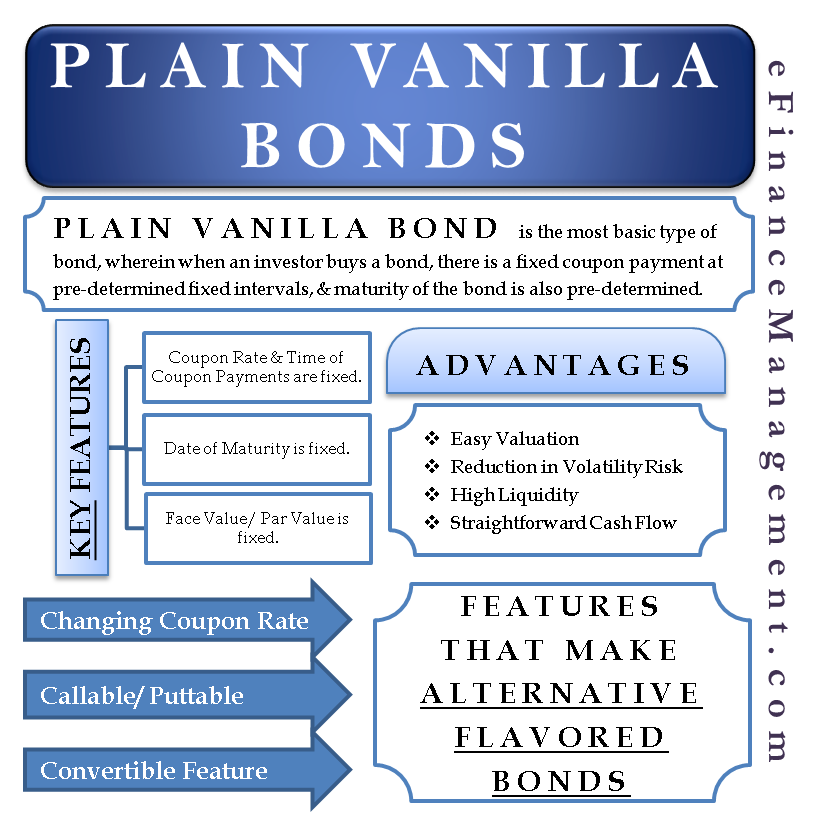

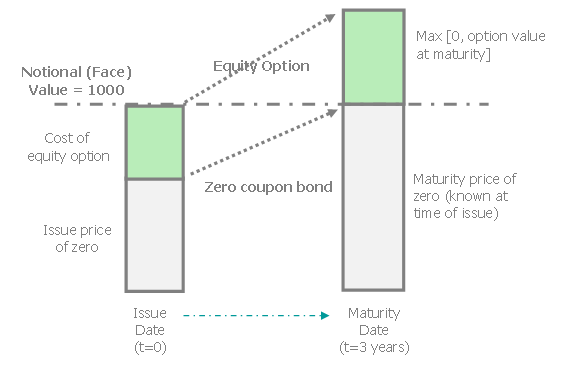

Zero-Coupon Convertible - Investopedia A zero-coupon security is a debt instrument which does not make interest payments. An investor purchases this security at a discount and receives the face value of the bond on the maturity date.... › terms › dDuration Definition and Its Use in Fixed ... - Investopedia Sep 01, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ... Plain Vanilla Bonds - Meaning, Features, Example, & Advantages A bond can be a zero-coupon bond, in which there is no coupon payment, or it can be a step-up bond, in which the coupon rate increase after a predetermined period of time, and there are also floating-rate bonds whose coupon rate keeps changing every few months. Such is not the case with plain vanilla bonds. United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 3.897% yield.. 10 Years vs 2 Years bond spread is 0.6 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.25% (last modification in September 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 46.80 and implied probability of ...

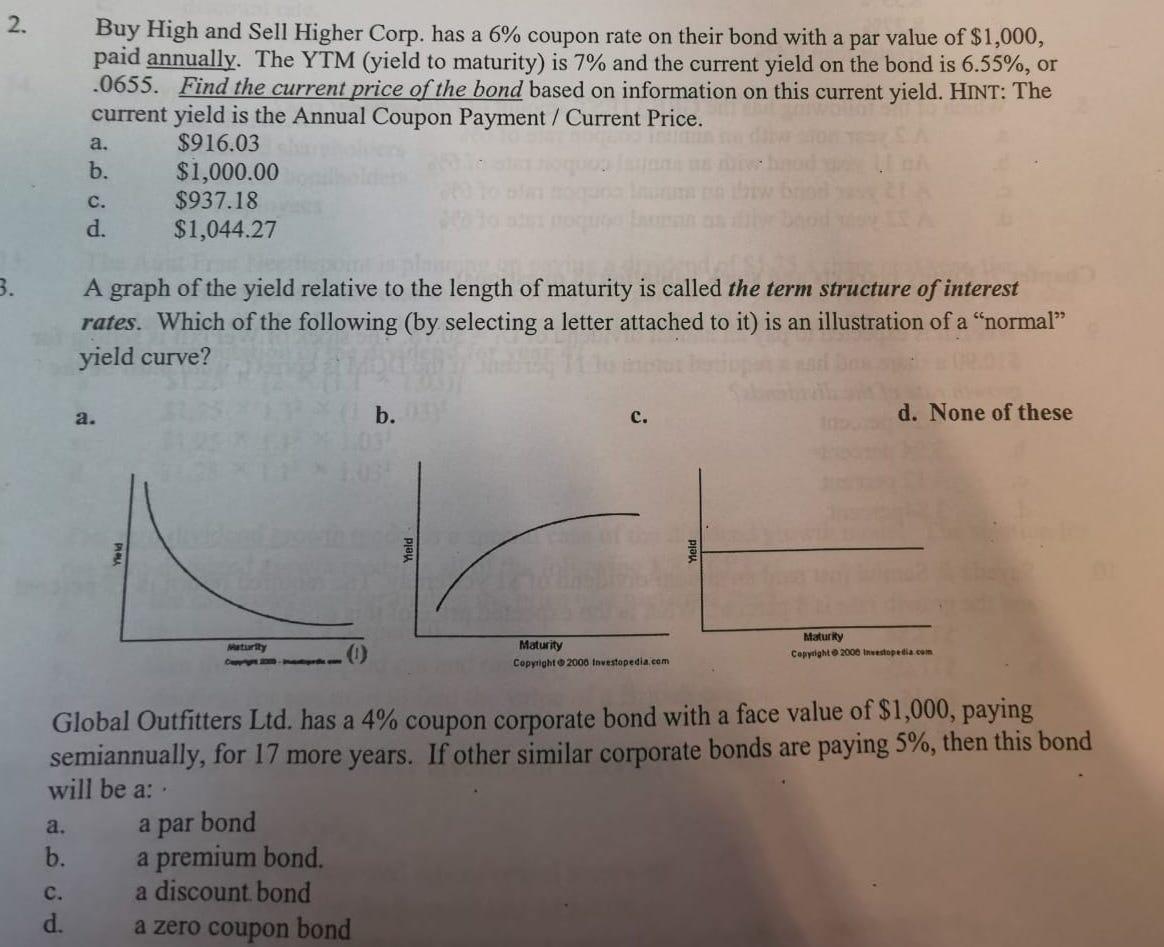

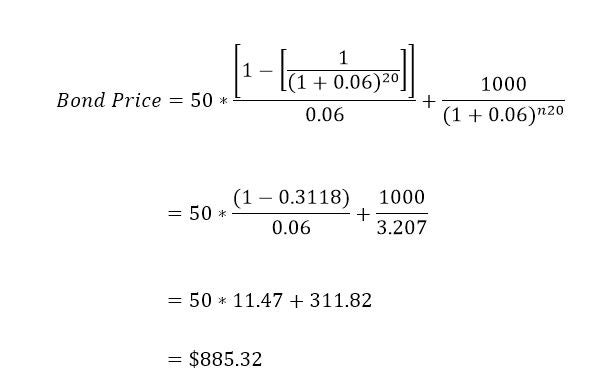

Bond Pricing | Valuation | Formula | How to calculate with example | eFM Calculate the price of a bond whose face value is $1000. The coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8 The following is the summary of bond pricing:

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an excellent...

Zero-Coupon Swap Definition - Investopedia A zero-coupon swap is a derivative contract entered into by two parties. One party makes floating payments which changes according to the future publication of the interest rate index (e.g. LIBOR,...

How to Calculate Yield to Maturity of a Zero-Coupon Bond Zero-coupon bonds essentially lock the investor into a guaranteed reinvestment rate. This arrangement can be most advantageous when interest rates are high and when placed in tax-advantaged retirement accounts. Some investors also avoid paying taxes on imputed interest by buying zero-coupon municipal bonds.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

38 zero coupon bonds advantages groww.in › p › government-bondsGovernment Bonds India - Types, Advantages and Disadvantages ... Zero-Coupon Bonds. As the name suggest...

India Government Bonds - Yields Curve India Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

:max_bytes(150000):strip_icc()/are-bonds-safer-than-stocks-58dc27f03df78c5162810026.jpg)

/GettyImages-983195940-6d4c5099c3314718a5ba16c33205d071.jpg)

:max_bytes(150000):strip_icc()/GettyImages-183367591-9f457266c3734eb6bb07e4ad05e5f2be.jpg)

:max_bytes(150000):strip_icc()/GettyImages-810720992-f4dcb14dc2674174a84be79d0d538f85.jpg)

/Cash-5b52a22a46e0fb003703909a.jpg)

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

/GettyImages-551987971-41276ca6a78044ab857859bb9f4e0ac1.jpg)

Post a Comment for "39 zero coupon bond investopedia"