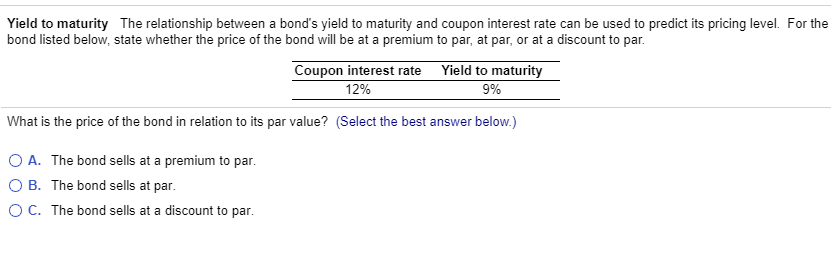

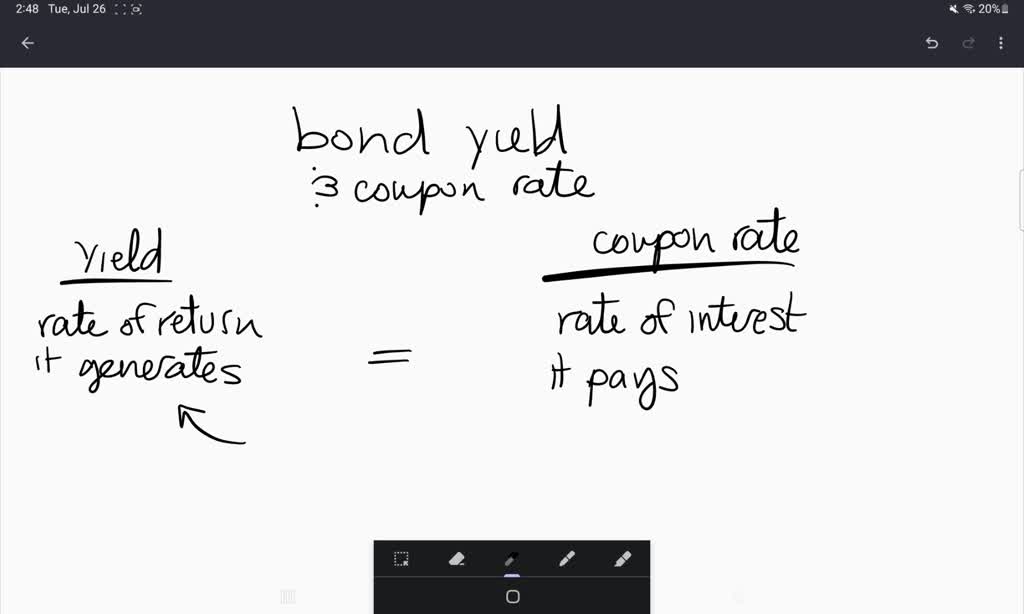

41 coupon vs interest rate

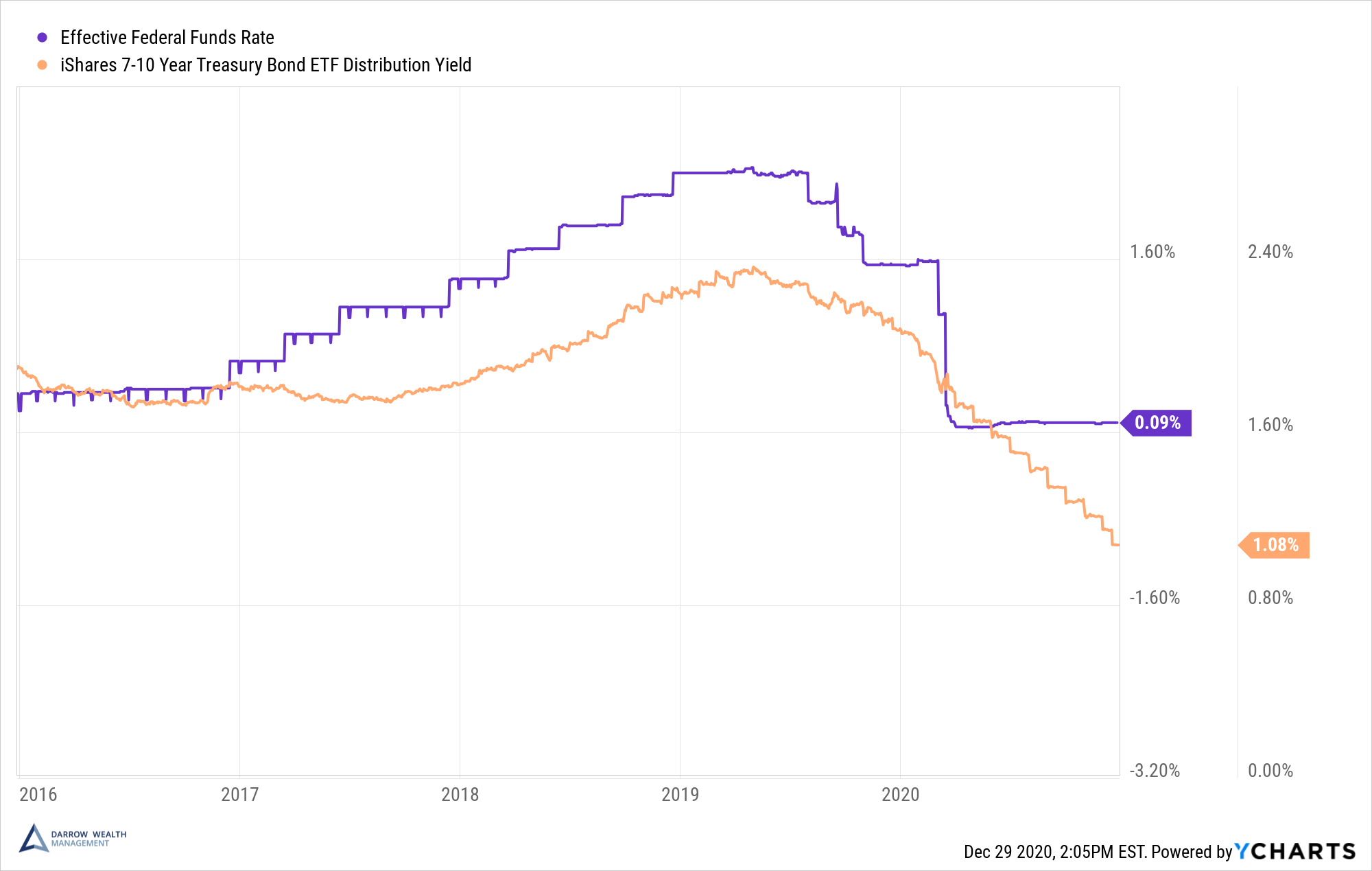

› ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. › terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

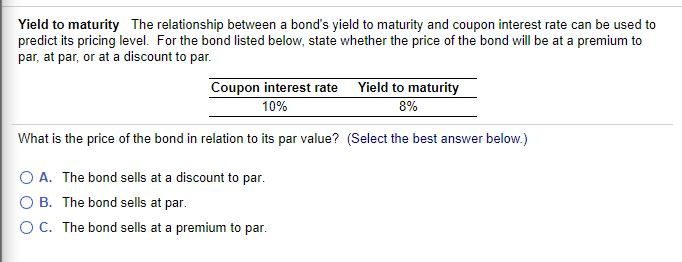

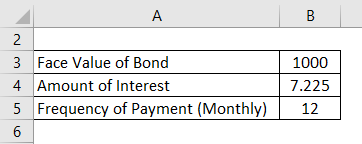

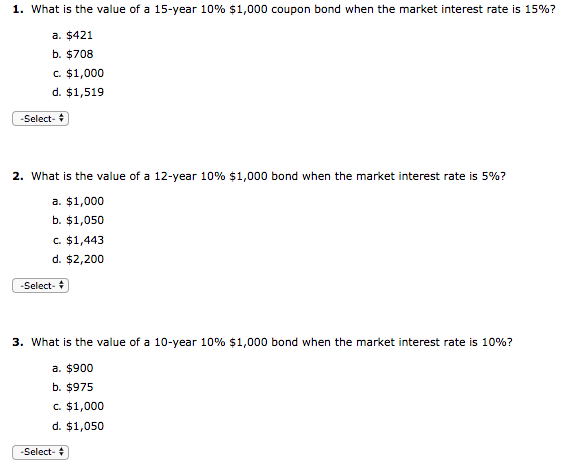

› coupon-rate-vs-interest-rateCoupon Rate vs Interest Rate | Top 8 Best Differences (with ... Coupon Rate vs. Interest Rate – Key Differences. The key differences between Coupon Rate vs. Interest Rate are as follows – The coupon rate is calculated on the face value of the bond Value Of The Bond Bonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a certain period. read more, which is being invested.

Coupon vs interest rate

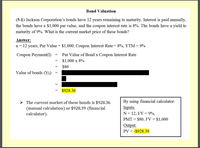

economictimes.indiatimes.com › definition › coupon-rateWhat is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ... Χ.Α + Markets (241): Πολλά μικρά και μεγάλα ενδιαφέροντα (24/10) 24.10.2022 · The bond has a 3-year maturity and is callable in year 2 with a coupon of 7.00% and a yield of 7.25%. The issuance was covered by institutional investors (55%), wealth management (20%), supranational organisations (13%) and asset managers (12%). Following the transaction, MREL pro-forma ratio stands at 19.5% as of 2Q22. The news is neutral and ... › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · Coupon Interest Rate vs. Yield . Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon ...

Coupon vs interest rate. › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... › publication › ppic-statewide-surveyPPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Seventy-six percent rate the nation’s economy as “not so good” or “poor.” Thirty-nine percent say their finances are “worse off” today than a year ago. Forty-seven percent say that things in California are going in the right direction, while 33 percent think things in the US are going in the right direction; partisans differ in ... › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · Coupon Interest Rate vs. Yield . Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon ... Χ.Α + Markets (241): Πολλά μικρά και μεγάλα ενδιαφέροντα (24/10) 24.10.2022 · The bond has a 3-year maturity and is callable in year 2 with a coupon of 7.00% and a yield of 7.25%. The issuance was covered by institutional investors (55%), wealth management (20%), supranational organisations (13%) and asset managers (12%). Following the transaction, MREL pro-forma ratio stands at 19.5% as of 2Q22. The news is neutral and ...

economictimes.indiatimes.com › definition › coupon-rateWhat is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

Post a Comment for "41 coupon vs interest rate"